SmartBeb - Actuarial your policy

Introduction

SmartBeb aims to help people obtain insurance information online and the sence of trust to insure sales. A new insurance process will improve customer protection and business professionalism.

Certain data and research are hidden due to confidentiality agreements

Timeline

2019.4~2020.1

Release time of the official version

Role

UI designer

Graphic design

Collaberators

Ray Kuo (PM)

Gaga Wu (GUI designer)

Mike Hsu (Front-end Developer)

Abstract

Design Process

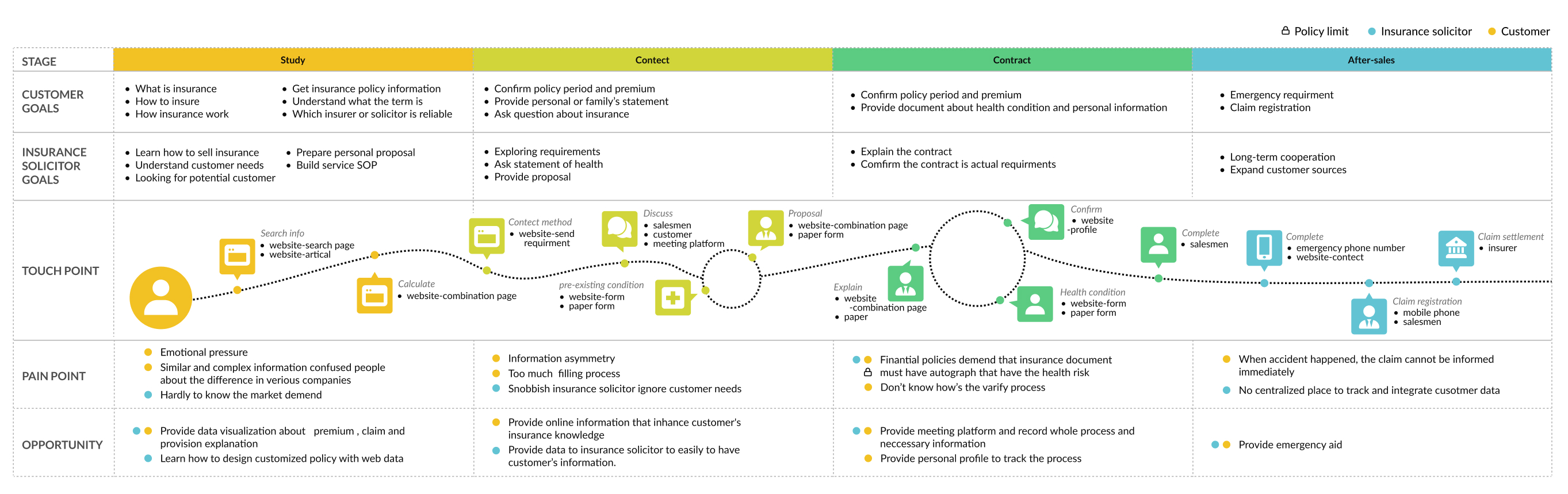

Goals

SmartBeb tried to develop new insurance calculator tool for both costemors and solicitor on their existing website. It is a pre-strategy for digitalize insurance in the future.

Tediously process (traditional offline insurance)

Interview

How’s the online insurance tool do?

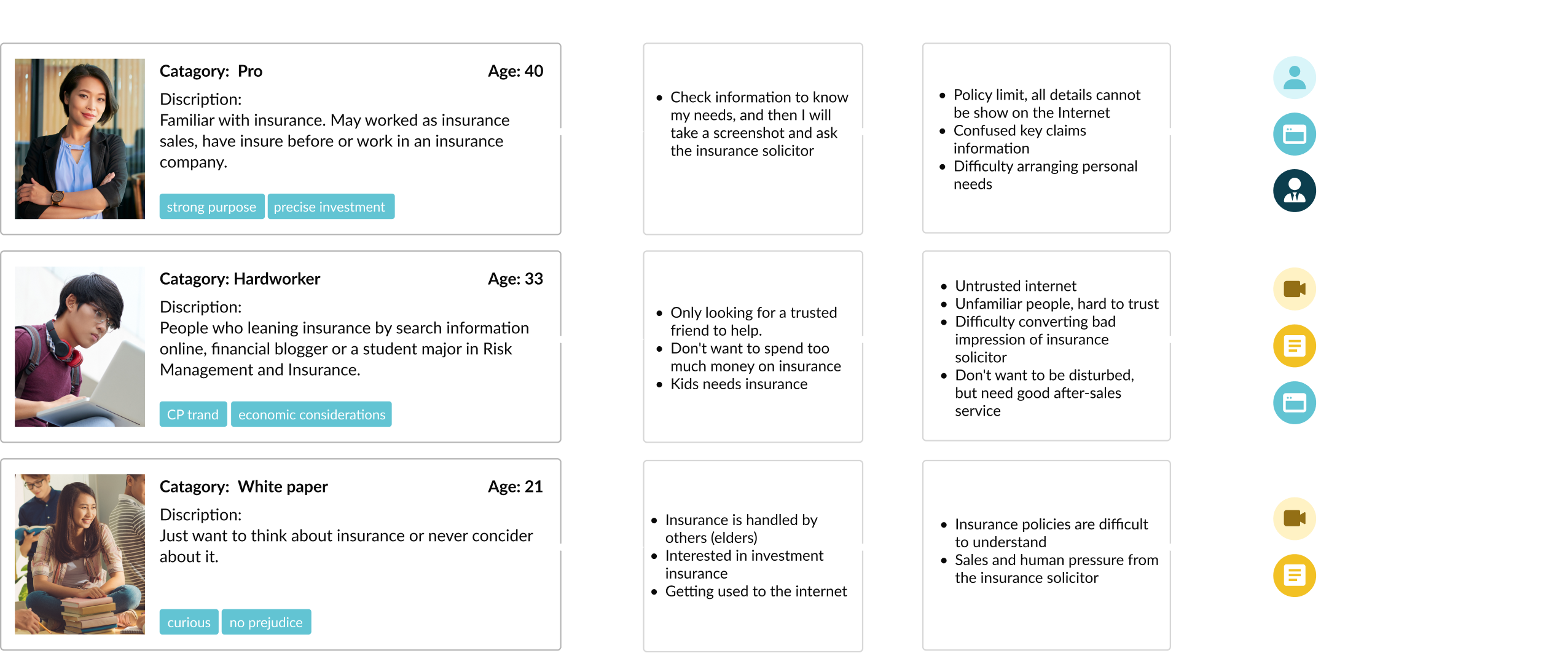

According to interviews, many people grew up with insurance arranged by their parents. They can't learn insurance knowledge from past experiences because it has totally different policies. In Taiwan, the morality and professionalism of insurance solicitors are generally questioned, so that many young people want to understand their needs before purchasing.

The purpose of this project is to teach users who need insurance to increase their knowledge of insurance and help them calculate the insurance premium they have to prepare through the information released on the Internet. In addition, these tools can increase the professionalism of the insurance solicitors in the company. It uses online tools to assist in business training, which can quickly gain insight of customer needs and give advice during their conversations with customers immediately.

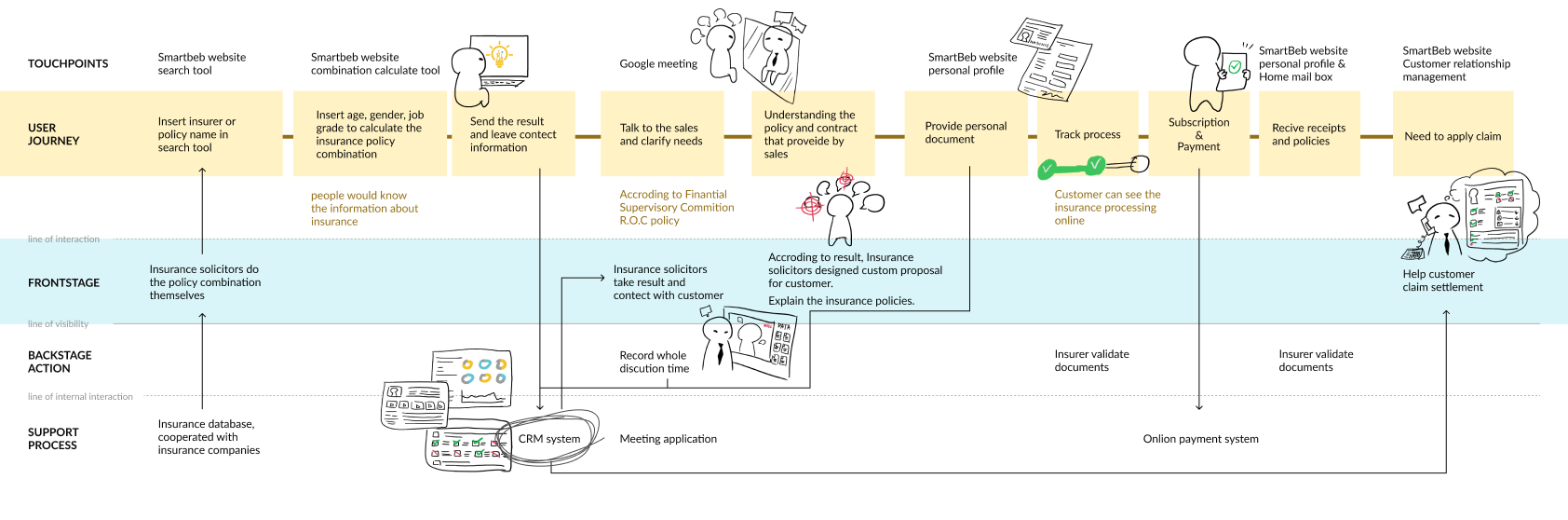

Service Blueprint

Effective online&offline process Combination

Features and structure

Planning

According to the requirements, we know that there are three things to do: optimize insurance recommendations, add product combinations and add product searches. The latter two are new functions and must be linked with the previous insurance recommendations.

Structure

Three mainly tools

- Insurance recommendation - Mainly users are the general public. Recommend the policy combinations that have been formed on the website.

- Searcher - Search all policies currently on file on the site.

- Insurance combination - Mainly users are insurance solictors. It is the function of freely combining insurance policies.

The three tools will eventually connect to each other and assist insurance solictors in the business process.

Flow chart

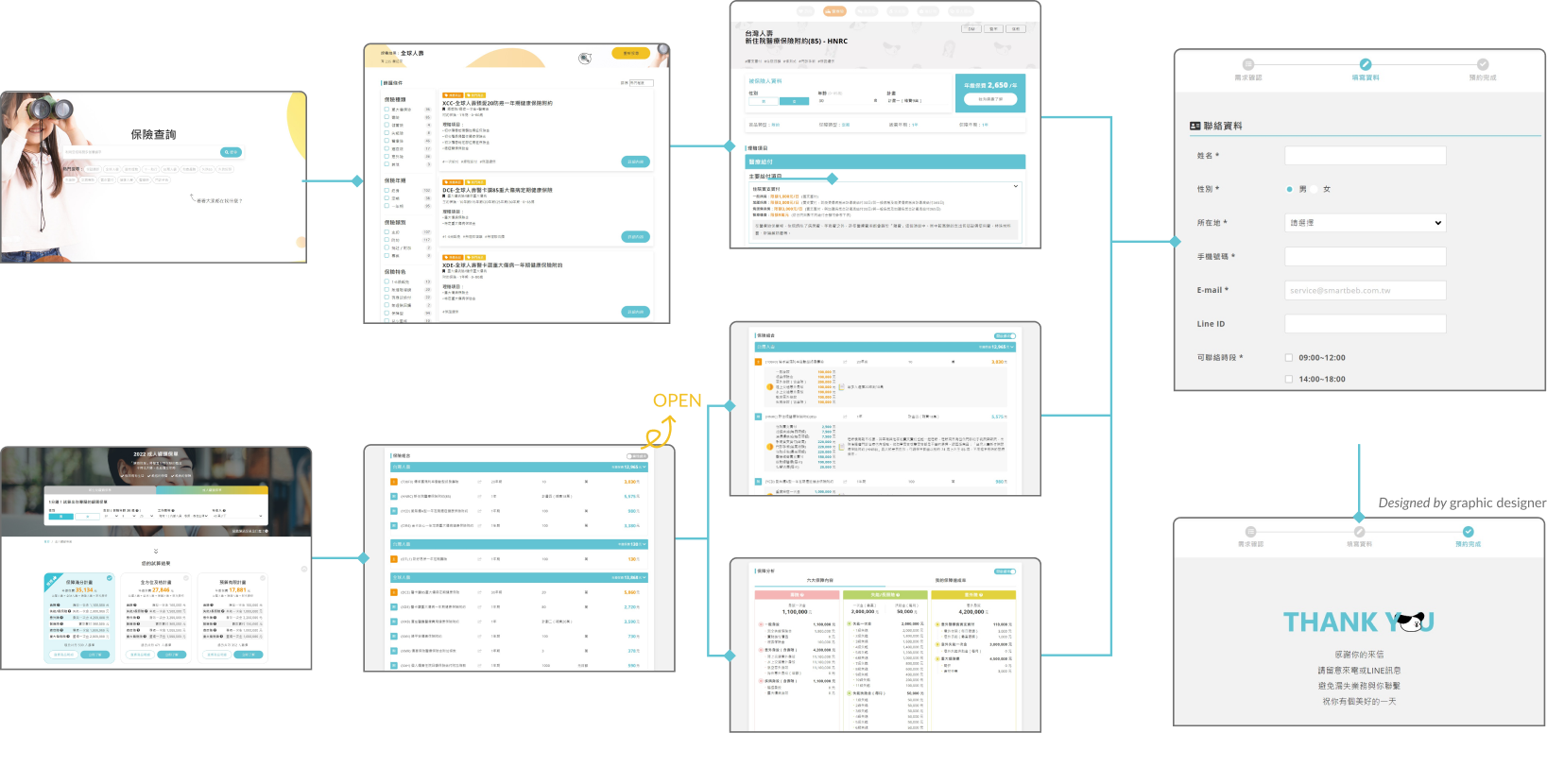

website Interface

Usability Testing

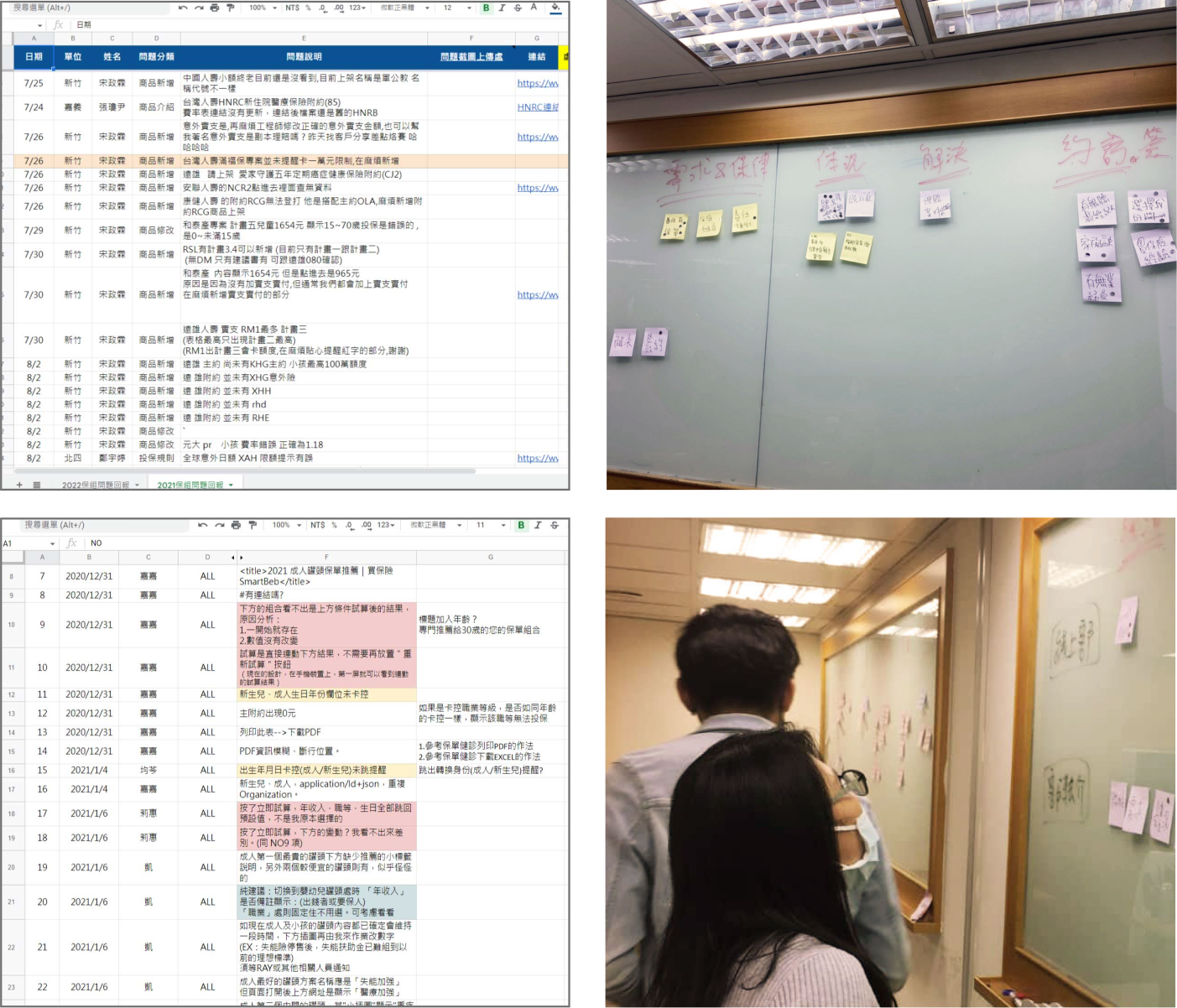

8 Insurance solictors test record

We conduct internal insurance solicitors tests and ask them to provide us with the database and problems encountered in the process. We even conduct A/B tests on the website to track customers' usage habits, and finally optimize the website according to the results. When encountering database errors, the process is interrupted, and the inability to leave orders conflicts with financial laws, we ask these financial experts to tell us the current processes and regulations. We hope that the product can be cut into their processes to facilitate them to analyze customers.

Workshop

In addition, we interviewed general customers and talked about their problems with online insurance for life insurance and health insurance. Most of them are still unfamiliar with online insurance. Although everyone is used to web inquiries, they still rely on the instructions of insurance personnel, resulting in some people being insured. Too much insurance is not necessarily helpful.

Final work

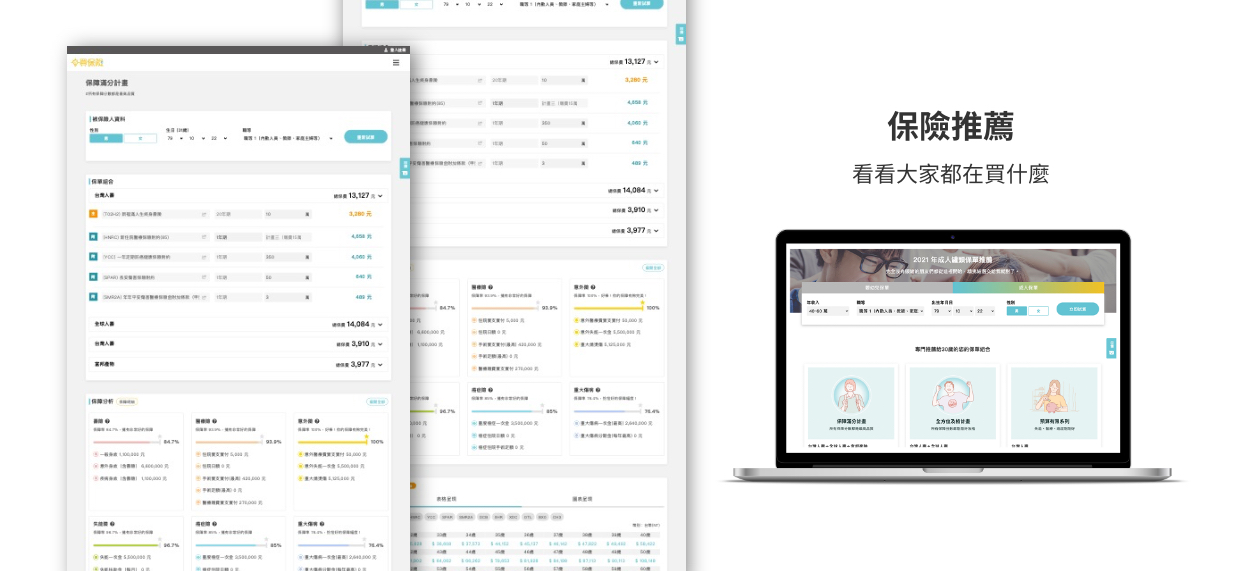

1.Insurance Recommend Page

Configured by insurance solictors. Users can calculate their own expenses in the combined insurance policy by inputting their personal conditions. The recommendation is eazy used, which are usually the most popular combination on the market.

-

White paper

-

Hardworker

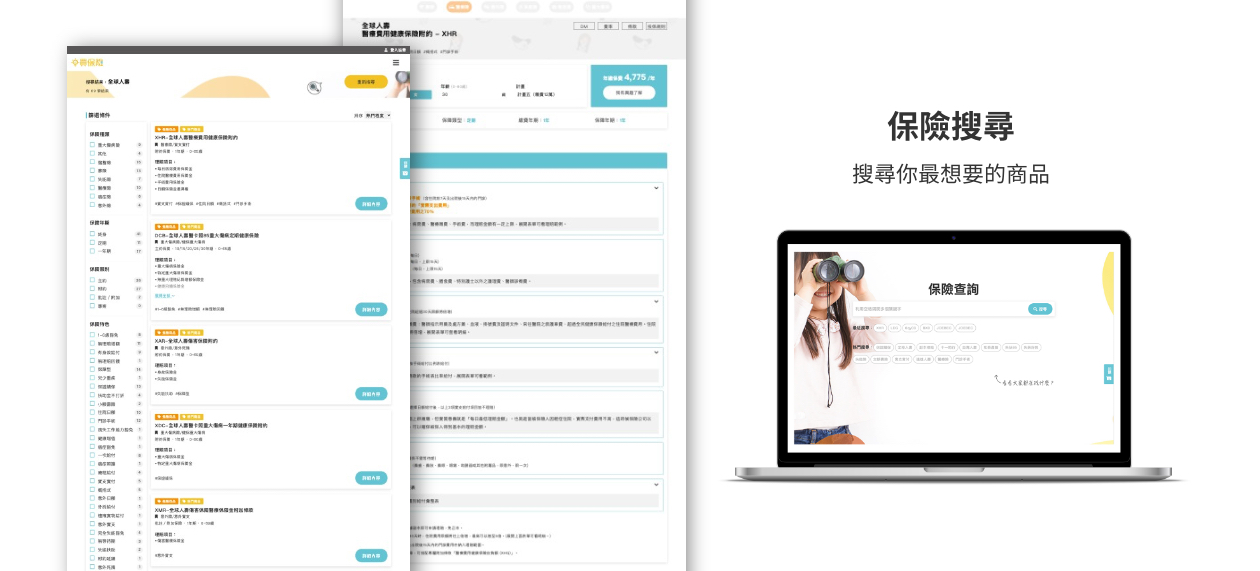

2.Search Page

Users can search for policies. Would learn about versions of latest or previous policies.

-

White paper

-

Hardworker

-

Pro

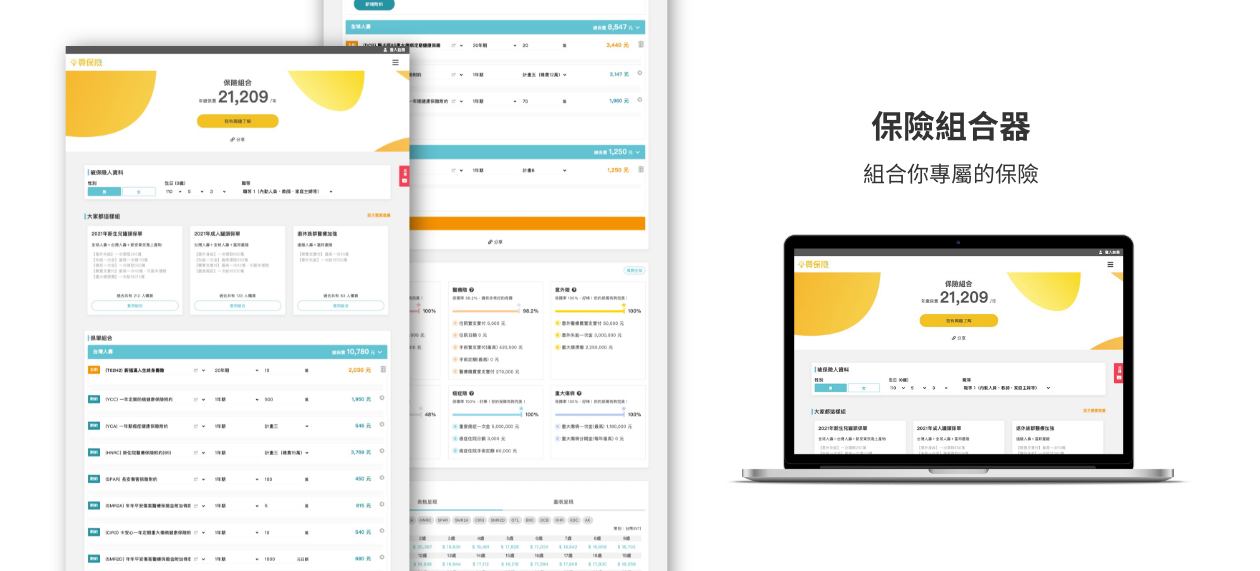

3.Combination set Page

Not only providing a combination of your own insurance, but also provides a ratio analysis of insurance types, a list of claim items and year-by-year premium tables and charts for reference. For Pro person use, these insurance knowledge experts can make a customized place to do their own insurance policies. Each insurance product item can also be linked to its individual information page.

-

Pro

This is the outpost function of an electronic insurance policy. The company wants to develop the insurance business into efficient professional risk management experts, not just the business of selling insurance. I have been away from this company for a long time. Looking at the current website is a little different from the original plan, but the concept is still there. This is a very good experience for me, which benefits me to gain a lot in the complex financial field.

Expend features for different needs

- Retire

- Buy a house

- Parenting

- Start a business

- Marry

- Single plan